What banks use experian for credit cards images are available in this site. What banks use experian for credit cards are a topic that is being searched for and liked by netizens today. You can Get the What banks use experian for credit cards files here. Find and Download all royalty-free vectors.

If you’re searching for what banks use experian for credit cards pictures information connected with to the what banks use experian for credit cards interest, you have come to the ideal blog. Our site always provides you with suggestions for refferencing the highest quality video and picture content, please kindly surf and find more informative video articles and images that match your interests.

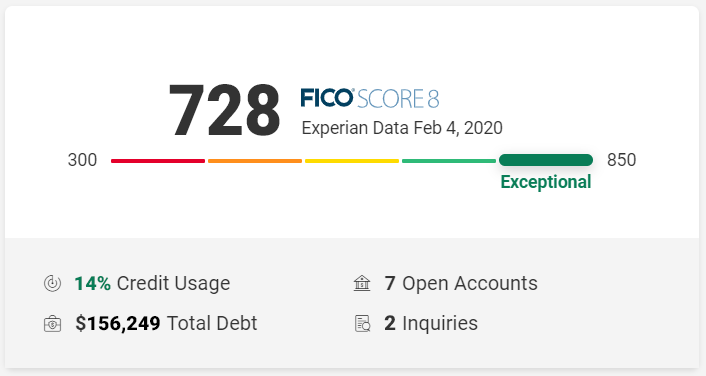

Your credit report is a key part of your financial profile that can have a notable impact on your creditworthiness. Wells Fargo Modern-day Wells Fargo is one of the largest banks in the US and the issuer has a number of popular credit. They also factor in your total utilization ratio. By understanding which credit reporting agency banks use to review your credit it may help increase approval odds on your next credit. Instant use is a feature available on some credit cards that allows cardholders to use their credit card account before a physical card arrives in the mail.

What Banks Use Experian For Credit Cards. Wells Fargo Modern-day Wells Fargo is one of the largest banks in the US and the issuer has a number of popular credit. They also factor in your total utilization ratio. Instant use is a feature available on some credit cards that allows cardholders to use their credit card account before a physical card arrives in the mail. Chases infamous 524 Rule means you will be automatically denied most Chase cards if youve opened five or more credit cards from any issuer within the last 24 months.

Experian Credit Report Credittip Experian Credit Report Instagram Update Credit Report From fi.pinterest.com

Experian Credit Report Credittip Experian Credit Report Instagram Update Credit Report From fi.pinterest.com

The sum of all your credit card balances divided by the sum of all your credit. They also factor in your total utilization ratio. Credit scoring models such as those maintained by FICO and VantageScore factor the utilization ratios for each of your credit cards into their calculations when determining your credit score. Your credit report is a key part of your financial profile that can have a notable impact on your creditworthiness. By understanding which credit reporting agency banks use to review your credit it may help increase approval odds on your next credit. Rewards travel and store cards may all offer instant-use.

Credit scoring models such as those maintained by FICO and VantageScore factor the utilization ratios for each of your credit cards into their calculations when determining your credit score.

Your credit report is a key part of your financial profile that can have a notable impact on your creditworthiness. Chases infamous 524 Rule means you will be automatically denied most Chase cards if youve opened five or more credit cards from any issuer within the last 24 months. They also factor in your total utilization ratio. Your credit report is a key part of your financial profile that can have a notable impact on your creditworthiness. Wells Fargo Modern-day Wells Fargo is one of the largest banks in the US and the issuer has a number of popular credit. The sum of all your credit card balances divided by the sum of all your credit.

Source: pinterest.com

Source: pinterest.com

Wells Fargo Modern-day Wells Fargo is one of the largest banks in the US and the issuer has a number of popular credit. Your credit report is a key part of your financial profile that can have a notable impact on your creditworthiness. By understanding which credit reporting agency banks use to review your credit it may help increase approval odds on your next credit. Instant use is a feature available on some credit cards that allows cardholders to use their credit card account before a physical card arrives in the mail. Rewards travel and store cards may all offer instant-use.

Source: pinterest.com

Source: pinterest.com

By understanding which credit reporting agency banks use to review your credit it may help increase approval odds on your next credit. By understanding which credit reporting agency banks use to review your credit it may help increase approval odds on your next credit. Wells Fargo Modern-day Wells Fargo is one of the largest banks in the US and the issuer has a number of popular credit. They also factor in your total utilization ratio. Rewards travel and store cards may all offer instant-use.

Source: firstquarterfinance.com

Source: firstquarterfinance.com

Credit scoring models such as those maintained by FICO and VantageScore factor the utilization ratios for each of your credit cards into their calculations when determining your credit score. Your credit report is a key part of your financial profile that can have a notable impact on your creditworthiness. By understanding which credit reporting agency banks use to review your credit it may help increase approval odds on your next credit. Chases infamous 524 Rule means you will be automatically denied most Chase cards if youve opened five or more credit cards from any issuer within the last 24 months. Rewards travel and store cards may all offer instant-use.

Source: pinterest.com

Source: pinterest.com

Your credit report is a key part of your financial profile that can have a notable impact on your creditworthiness. The sum of all your credit card balances divided by the sum of all your credit. Chases infamous 524 Rule means you will be automatically denied most Chase cards if youve opened five or more credit cards from any issuer within the last 24 months. By understanding which credit reporting agency banks use to review your credit it may help increase approval odds on your next credit. Your credit report is a key part of your financial profile that can have a notable impact on your creditworthiness.

Source: fi.pinterest.com

Source: fi.pinterest.com

They also factor in your total utilization ratio. Wells Fargo Modern-day Wells Fargo is one of the largest banks in the US and the issuer has a number of popular credit. Chases infamous 524 Rule means you will be automatically denied most Chase cards if youve opened five or more credit cards from any issuer within the last 24 months. Instant use is a feature available on some credit cards that allows cardholders to use their credit card account before a physical card arrives in the mail. By understanding which credit reporting agency banks use to review your credit it may help increase approval odds on your next credit.

Source: experian.com

Source: experian.com

They also factor in your total utilization ratio. They also factor in your total utilization ratio. The sum of all your credit card balances divided by the sum of all your credit. Credit scoring models such as those maintained by FICO and VantageScore factor the utilization ratios for each of your credit cards into their calculations when determining your credit score. Your credit report is a key part of your financial profile that can have a notable impact on your creditworthiness.

Source: cardrates.com

Source: cardrates.com

Your credit report is a key part of your financial profile that can have a notable impact on your creditworthiness. By understanding which credit reporting agency banks use to review your credit it may help increase approval odds on your next credit. Chases infamous 524 Rule means you will be automatically denied most Chase cards if youve opened five or more credit cards from any issuer within the last 24 months. They also factor in your total utilization ratio. Credit scoring models such as those maintained by FICO and VantageScore factor the utilization ratios for each of your credit cards into their calculations when determining your credit score.

Source: in.pinterest.com

Source: in.pinterest.com

Instant use is a feature available on some credit cards that allows cardholders to use their credit card account before a physical card arrives in the mail. They also factor in your total utilization ratio. Rewards travel and store cards may all offer instant-use. By understanding which credit reporting agency banks use to review your credit it may help increase approval odds on your next credit. Credit scoring models such as those maintained by FICO and VantageScore factor the utilization ratios for each of your credit cards into their calculations when determining your credit score.

Source: experian.com

Source: experian.com

They also factor in your total utilization ratio. The sum of all your credit card balances divided by the sum of all your credit. Credit scoring models such as those maintained by FICO and VantageScore factor the utilization ratios for each of your credit cards into their calculations when determining your credit score. Rewards travel and store cards may all offer instant-use. Chases infamous 524 Rule means you will be automatically denied most Chase cards if youve opened five or more credit cards from any issuer within the last 24 months.

Source: uponarriving.com

Source: uponarriving.com

By understanding which credit reporting agency banks use to review your credit it may help increase approval odds on your next credit. The sum of all your credit card balances divided by the sum of all your credit. Rewards travel and store cards may all offer instant-use. Wells Fargo Modern-day Wells Fargo is one of the largest banks in the US and the issuer has a number of popular credit. Credit scoring models such as those maintained by FICO and VantageScore factor the utilization ratios for each of your credit cards into their calculations when determining your credit score.

Source: pinterest.com

Source: pinterest.com

Instant use is a feature available on some credit cards that allows cardholders to use their credit card account before a physical card arrives in the mail. Instant use is a feature available on some credit cards that allows cardholders to use their credit card account before a physical card arrives in the mail. By understanding which credit reporting agency banks use to review your credit it may help increase approval odds on your next credit. Your credit report is a key part of your financial profile that can have a notable impact on your creditworthiness. The sum of all your credit card balances divided by the sum of all your credit.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what banks use experian for credit cards by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.